When importing invoices from an external system you find penny differences between how tax is calculated between these two applications. Integrating thousands of invoices can surmount to a whole free beer a day appearing on your ledger books, much to the disdain of our client's accountant. A decision was therefore taken to send me to New Zealand for the week to fix the problem and force Ax to accept some different tax rounding rules.

|

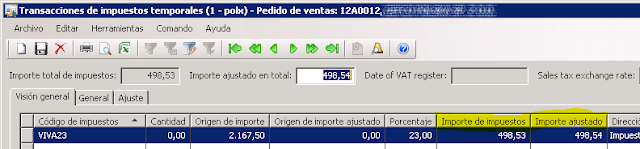

| A penny difference in how Ax and an external system calculates taxes. |

|

| When registering a sales invoice it is possible to manually adjust the tax amount, per tax code. |

|

| This is what we want to do, via X++. |

static void XXX_AdjustSalesTaxesJob(Args _args)

{

//Manually adjust sales taxes

TaxRegulation taxRegulation;

SalesTable salesTable;

SalesTotals salesTotals;

;

salesTable = SalesTable::find('12A0012');

if (salesTable)

{

salesTotals = SalesTotals::construct(salesTable, SalesUpdate::All);

salesTotals.calc();

// Launch the form to manually adjust the taxes (TaxTmpWorkTrans)

// --------------------------------------------------------------

//Tax::showTaxes(salesTotals.tax(), salesTable);

// Or do it by X++

// ---------------

ttsBegin;

// EDIT: I've just realised that this method has been modified in the GLP-EE patch

// taxRegulation = TaxRegulation::newTaxRegulation(salesTotals.tax(), null);

taxRegulation = TaxRegulation::newTaxRegulation(salesTotals.tax(), null, salesTable, null, null);

taxRegulation.allocateAmount(498.54);

taxRegulation.saveTaxRegulation();

ttsCommit;

}

}

The same can be done for purchase invoices. In my example once more we have a penny difference in the tax calculation, it should be 13.60.

|

| Purchase order, with 14.60 PLN of taxes we need to apply |

static void XXX_AdjustPurchTaxesJob(Args _args)

{

TaxRegulation taxRegulation;

PurchTable purchTable;

PurchTotals purchTotals;

;

purchTable = PurchTable::find('129/2012');

if (purchTable)

{

purchTotals = PurchTotals::newPurchTable(purchTable, PurchUpdate::All);

purchTotals.calc();

// Launch the Form to manually adjust the taxes (TaxTmpWorkTrans)

// --------------------------------------------------------------

//Tax::showTaxes(purchTotals.tax(), purchTable);

// Or do it by X++

// ---------------

ttsBegin;

taxRegulation = TaxRegulation::newTaxRegulation(purchTotals.tax(), null, null, purchTable, null);

if (taxRegulation.taxLinesExist())

{

taxRegulation.allocateAmount(13.60);

taxRegulation.saveTaxRegulation();

}

ttsCommit;

}

}

HOWEVER. What happens when we have two tax codes in the same invoice?

|

| Two tax codes, one value to change. |

You people with the AX 2009 Eastern European patch have been warned.

Our changes are all recorded in the TaxWorkRegulation entity, should you need to check your changes across invoices.

|

| TaxWorkRegulation - The entity that stores the adjusted taxes we have applied... Where is my second line? |

Edit: Found another possible bug, or it's my lack of knowledge. Registering changes to taxes for the Purch* entities, I could only do it by changing the HeadingTableId and HeadingRecId values to that of PurchParmTable (343), and not PurchTable (345). This is probably something to do with rearranging the purchase lines.

Remember people: Taxes are hard. Let's go tax-free shopping!

you're such a life saver, Thanks for this awesome post.

ResponderEliminar